If Martians happened to check out the cover photos of typical earthly retirement product brochures (perhaps out of an interest to retire here), they would be forgiven for thinking retirement is all about walking along beaches at low tide wearing white linen clothes with lots of smiles. Is this true? (The retirement thing, not the Martians thing). Well, we know the last bit, lots of smiles, is true in several ways and in ways people may not imagine.

This post will go through how smiles are applicable in retirement in three ways and why people bang on about retirement planning, even if it’s the last thing you may be interested in.

# 1: The Happiness Smile

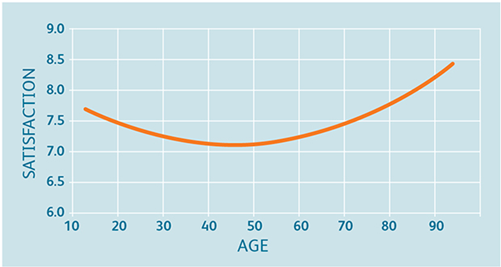

Psychology has studied the relationship between happiness and age and it happens to be shaped like a smile. The studies (references at the bottom for the keen readers) have found that happiness tends* to be highest in early adulthood, decreases in midlife, and then increases again in later life, particularly after retirement. *Many factors and exceptions contribute to this trend, including country, health, social relationships, family circumstances and life events.

Below is the first smiley graph taken from the Brookings Institute study, which found that happiness peaked at 98!

# 2: The Spending Smile

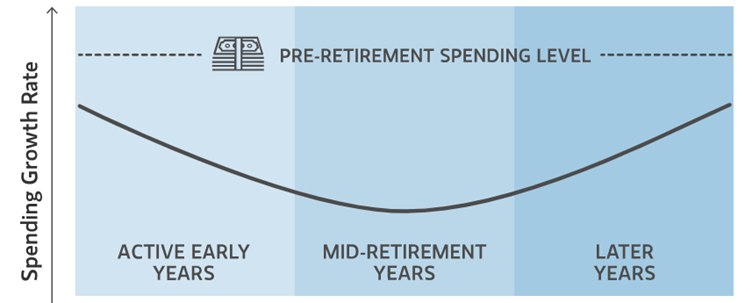

There’s a tendency towards smile-shaped spending through retirement, initially spending up, then reducing spending and then spending up again, as follows:

- The “go-go” years are the active-early years when retirees spend more as they get out and about, travel and catch up on items they couldn’t do whilst working.

- The “slow-go” years are when retirees slow down either out of necessity or by enjoying the simpler things in life. Spending typically drops as a result.

- The “no-go” years are when health issues trigger some significant expenses, such as aged care and health expenses. Sometimes, a partner will need aged care, while the other partner remains in the family home, which can be the equivalent cost of owning two homes.

# 3: The Retirement S.M.I.L.E

This last ‘smile’ explains why so many people bang on about the importance of planning for retirement: it’s complex.

In December, I conducted a JANA research trip with a colleague through five countries over thirty meetings with pension funds, asset managers and fellow consultants to investigate how other countries navigate decumulation. One of JANA’s many roles is to help super funds with retirement solutions and seeing the experiences of other countries was really useful. One theme of the trip was the universality of the challenges: decumulation is complex. Decumulations is so complex that Noble prize winner Bill Sharpe called it the ‘nastiest, hardest problem in finance’ (his other less catchy quote is that it’s ‘tough, tough, tough’).

Investing at any stage has complexities, but retirement has heightened complexity because people are switching off a huge source of financial support in the form of a salary income and are relying on investments and government social security. Some of the detail behind the complexity is captured in the acronym S.M.I.L.E.:

- Sequencing risk is the risk of poor timing of your investment returns, resulting in less money for your retirement. An extreme example is retiring on the eve of a prolonged financial crisis, where your retirement drops dramatically. If you are still working, such an event can be beneficial investment-wise as you invest into a cheaper market.

- Market risk – not knowing what returns your investments will provide. All uncertainties like this make it tricky to plan.

- Inflation when the cost-of-living increases and your investments don’t keep up. When you are working, this risk is mitigated by having a salary that hopefully keeps up with inflation.

- Longevity – we don’t know how long we will live, and as above, all uncertainties like this make it tricky to plan.

- Expenses – there will be unknown expenses that you get hit with, especially health and aged-related expenses, which makes planning for retirement tricky.

This news may wipe people’s smiles off, but there’s lots of good news: most Australians are relatively very well positioned. Aside from Australia’s ‘lucky’ country factors, we also have well-established health, superannuation, and social security systems. While none of the systems are perfect (there is no perfection), the combination positions Australians incredibly well.

And on the retirement front, many sharp-minded people are working on solutions to the ‘nastiest, hardest problem in finance’. This means instead of having to navigate the complexity of retirement on our own, we will access products that will do the heavy lifting for us and cover off the key risks. This should put a smile on our dial.

Our role is to ensure we drip-feed money into super over time and let compounding do its magic.

Various references:

# 1: The Happiness Smile:

- Graham, C., & Ruiz Pozuelo, J. (2015, November 9). Is happiness just a matter of waiting for the right age? Brookings Institution.

- Blanchflower, D. G., & Oswald, A. J. (2008). Is well-being U-shaped over the life cycle? Social Science & Medicine, 66(8), 1733-1749.

- Carstensen, L. L., Fung, H. H., & Charles, S. T. (2003). Socioemotional selectivity theory and the regulation of emotion in the second half of life. Motivation and Emotion, 27(2), 103-123.

- Diener, E., Oishi, S., & Lucas, R. E. (2015). National accounts of subjective well-being. American Psychologist, 70(3), 234-242.

# 2: The Spending Smile

- Ameriks, J., Caplin, A., Leahy, J., & Tyler, T. (2003). Measuring self-control problems. American Economic Review, 93(2), 206-211.

- Finke, M. S., Huston, S. J., & Jenkins, J. J. (2011). The degree and determinants of spending decrease at retirement. Journal of Financial Planning, 24(4), 46-53.

- Hurd, M. D., & Rohwedder, S. (2010). The level and risk of out-of-pocket health care spending. Social Security Bulletin, 70(4), 51-72.